Automation You Can Trust.

Blind trust in AI is risky. We built an engine that shows its work.

Automate the heavy lifting, verify the results, and get deep financial planning insights to better connect with your clients.

Trust, But Verify.

Stop manual entry, but keep full control. We map the digital structure of common financial planning documents to give you a head start, not a black box.

Human-in-the-Loop Validation

We don't just scrape numbers; we highlight them for your review.

- Math Validation Checks: We automatically check if Gross Pay - Deductions = Net Pay. If the math doesn't add up, we flag it.

- Source Traceability: Extractions show you the page the data was found.

- Burn After Reading: Automatically delete source files immediately after extraction for total privacy.

The "Fiduciary Stamp"

Data not approved until you review, adjust assumptions, and click "Approve."

Status: Pending Review

"Review the extracted investments and mark approved."

Eliminate State Tax Drag.

Automated 1099 Analysis.

Clients often overpay state taxes because standard 1099s obscure US Government Obligations within mutual funds. We extract the hidden data, apply the 50% threshold rules, and generate audit-ready workpapers for your CPA.

Treasury Detection

We identify funds like Vanguard Federal Money Market and calculate the exact percentage attributable to US Obligations.

Audit-Ready Workpapers

Download a clean PDF with the specific lines bookmarked and state-specific instructions (e.g., California Schedule CA).

Schwab 1099 Composite

Page 14 • Tax-Exempt Analysis

Instant Income Intelligence.

From Paystubs.

Upload ADP paystubs. We extract the data and structure it into clarity. Support for extracting data to generate client-ready withholding recommendations for retirement accounts and taxes.

Retirement Optimization

Calculate exact contribution adjustments.

Tax Withholding

Generate withholding recommendations based on our flexible calculator.

Portfolio Data.

Without the Manual Drudgery.

Upload a Vanguard, Fidelity, or Schwab statement PDF. Fin Pods doesn't just grab numbers; we isolate specific accounts.

Our engine automatically detects the Account Type (IRA, Roth, Indiv) and the Last 3 Digits to ensure you are mapping the right data to the right account.

Leverage Your Other Tools

RightCapital

Review spreadsheet before import.

FT Apex Portfolios

Portfolio analysis export.

Fidelity_May_2025.pdf

Account Detected

Individual - TOA

Ending in 289

| Symbol | Qty | Cost Basis | Value |

|---|---|---|---|

| VTI | 452.10 | $89,450 | $102,401 |

| VXUS | 120.00 | $7,100 | $6,840 |

| CASH | - | - | $1,200 |

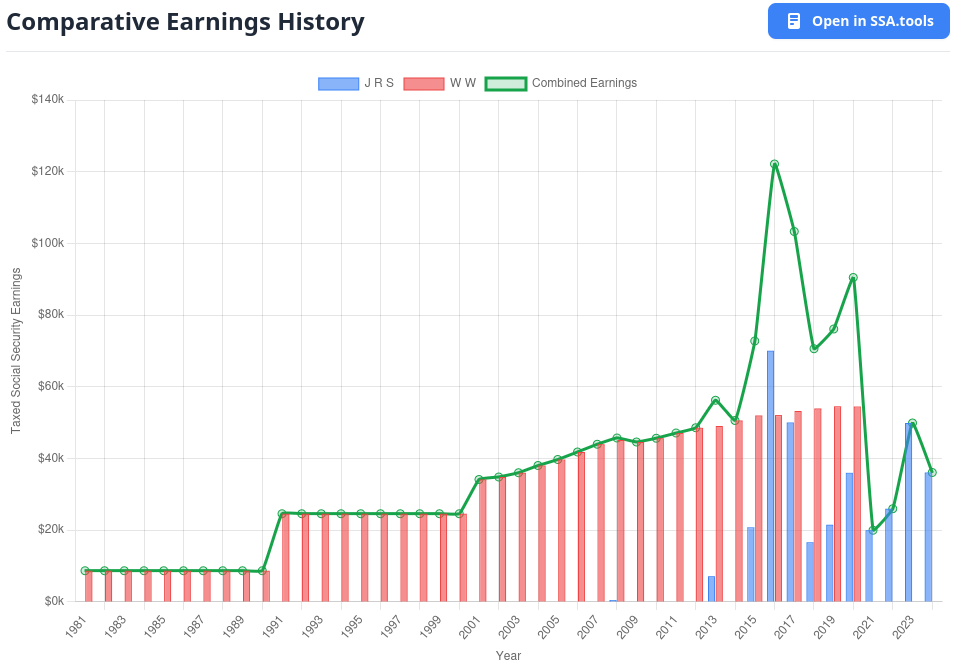

Social Security Optimized.

Upload SSA statements for your clients. Our engine standardizes the PDF data so you can instantly generate a Income Comparison.

Verify the earnings history, then export your extracted data directly into SSA.tools projection suite to analyze claiming strategies.

- Extracts PIA

- Earnings History

- Spousal Comparison

- Annual FRA for eMoney

Your Data. Your Workflow.

We don't trap your data. Every extraction is fully auditable and exportable.

Excel / CSV

Clean, structured tables ready for your custom spreadsheets.

Raw JSON

Building a custom app? Get the raw structured data object.

Includes 5,000 Extraction Credits per month.